“How can I connect marketing activities directly to revenue?”, asked a marketing leader on one of the online groups I am a part of.

This individual was having a tough time justifying his ask for marketing spend. As the conversation progressed I realized this was a common challenge.

In some marketing circles, the revenue impact question is still a valid one. Especially if the organization is steeped in legacy marketing mindsets.

However, in B2B SaaS marketing one needs to figure out the answer to that question before even starting on any marketing campaigns. There is no room for ‘winging it’ in the modern marketing era.

Without an answer to that question, it would be impossible to get a marketing budget approved in my world. The marketing team at Fusebill generates 99% of the closed-won leads on the inbound channel, and lately the outbound side as well. Our sales targets are, in fact, driven by the marketing commit on lead generation.

As a result, Fusebill’s marketing activities are laser focussed on revenue generation. This is likely the case for many B2B SaaS companies.

All the hustle porn, Facebook likes, Twitter retweets, and Linkedin video comments can amount to little or no predictable revenue without a grasp of the direct impact marketing has on revenue.

You absolutely need to understand how marketing activities generate SaaS revenue on a daily/monthly/quarterly/yearly basis. Unless that is, your accelerating SaaS growth is product-led or the product has an amazing viral-coefficient. Zoom is an example of such a B2B SaaS product that unlocked viral growth.

However, a majority of B2B SaaS products are not in that league.

Most B2B SaaS companies solve complex productivity problems for their customers. These solutions often involve a fairly lengthy process of educating prospects, overcoming digital transformation challenges, and working through relatively complex implementation procedures. Like implementing a CRM in an organization previously used to working with spreadsheets.

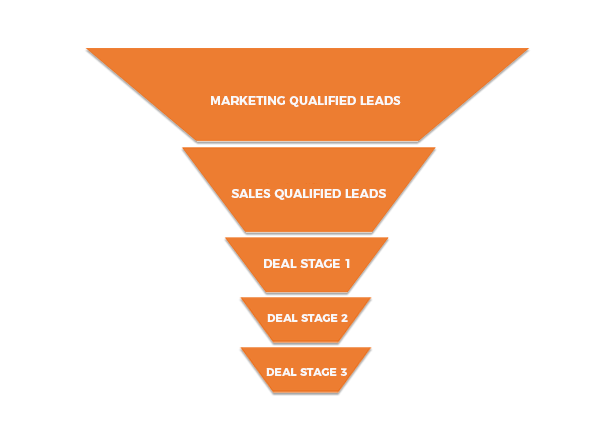

To grow and scale most B2B SaaS businesses often have to progress through multiple stages like

- Product-market fit

- Predictable recurring revenue generation, while keeping expenses under control

- Scale-up challenges including a focus on retention and sustainable scalability

Supporting these stages requires the B2B SaaS marketing team to be agile, revenue-focussed, customer-oriented, and highly sales-aligned. There’s a simple spreadsheet to help with B2B GTM Conversion Tracking.

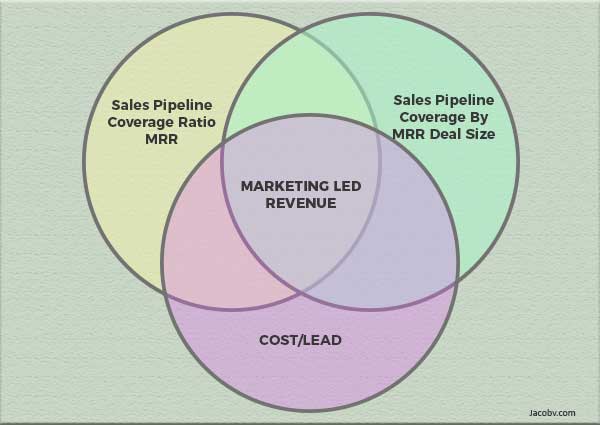

Using the spreadsheet will help monitor the progress of 3 interdependent KPIs that help the SaaS marketing team step up to the challenge.

1. X times Sales Pipeline Coverage in New MRR (Monthly Recurring Revenue)

While this number has traditionally been a sales concern, modern SaaS B2B marketing teams need to commit to adequate sales pipeline coverage as a success metric.

The metric is calculated as a multiple of the period’s sales target based on historical conversion rates.

Conventional wisdom on sales pipeline to sales quota ratio states that the number should be 3x. However, the ideal number for your B2B SaaS business is dependent on the historical sales trends that apply to your organization.

E.g.:

Your monthly sales target is $10,000 in New MRR.

The sales team has historically converted 20% of the pipeline to customers.

So the marketing commit on sales pipeline coverage target for the month should be $50,000 in MRR. Which is 5x the New MRR sales target for the month.

Pros of the KPI:

- Marketing-sales alignment: The marketing team’s focus shifts from anyone-with-a-pulse MQLs (Marketing Qualified Leads), to prospects with higher purchase intent.

The metric implicitly acknowledges that there is an overlap of the sales and marketing funnels. The bottom of the marketing funnel feeds into the top of the sales funnel.

The sales pipeline coverage ratio forces marketing teams to take a holistic view of the revenue pipeline and the customer journey through it, downstream from the marketing touchpoints.

Your marketing team and sales team will now work towards the same goal, to ensure sales targets are met.

- Vanity metrics are not a focus: Sales-relevant content creation, for paid as well as organic channels, targeting the ICP (Ideal Customer Profile) and buyer persona, becomes more important. If you have to generate adequate sales pipeline coverage, each piece of content should be created with that focus.

Vanity metrics like the number of likes and retweets are no longer as important when prospects with high-purchase intent activity are targeted.

Challenges:

- Sales and marketing leadership needs a collaborative environment: It is often assumed that sales and marketing teams have an antagonistic relationship. In my opinion, this kind of relationship is archaic, a holdover from the days of traditional marketing.

The integration of sales ops and marketing ops is increasingly vital to SaaS revenue marketing success. Without an environment of collaboration with the sales team, it is difficult to drive healthy sales pipeline coverage. - Well-defined processes need to be implemented: There should be lucid SLAs (service-level agreements) between sales and marketing on follow-ups on leads delivered by marketing. This is typically difficult to implement in a legacy sales-marketing environment where there is a lack of trust between the two departments.

Without a defined process for follow-ups and lead-stage documentation, it becomes impossible to track the success of sales pipeline coverage.

Not only should sales be prompt on follow-ups, but the pre-qualification and post-qualification process also should be supported by diligent CRM updates on the prospect’s journey through the process.

Qualification of opportunities and potential MRR value should be left to the sales team and not the marketing team. This level of interdependence will encourage healthy feedback loops on what success means to the sales team and what the marketing team has to do to get there. - May not work as well for small-volume niches: Some products are targeted at very small niches. The marketing efforts that are highly targeted may not generate enough lead volume to sustain the business. In such cases, broadening targeting to cover more of the TAM (Total Addressable Market) and educating potential customers through to the journey to your product may be necessary.

Ideally, you are not in the business of selling trombone oil. As Robert Iger’s biography mentions,

“Avoid getting into the business of manufacturing trombone oil. You may become the greatest trombone-oil manufacturer in the world, but in the end, the world only consumes a few quarts of trombone oil a year!”

– Dan Burke

- Susceptibility to inflated sales pipelines: There can be situations where the sales team requires a high coverage ratio to compensate for their underperformance.

Clarity on the quantity and quality of the sales pipeline down to each sales rep provides an opportunity to adequately staff, coach, and build an effective sales team. It is important to ensure that there are incremental improvements in the closing ratios – by deal stage, and by sales rep.

The pipeline coverage could also be inflated by deals that may not close in the immediate future. Therefore, the sales team should be vigilant about their weighted pipeline and provide visibility on this information to the marketing team.

There is always the chance that the sales pipeline is inflated by an outsized MRR deal value and thus masks a sales pipeline coverage shortage. More about this in the next KPI.

2. New MRR Sales Pipeline Coverage by Deal Size Cohort

Piggy-backing on the first KPI, the sales pipeline by New MRR deal size cohort will help you further optimize your B2B SaaS marketing efforts for revenue.

Digging deeper into the first KPI yields the sales pipeline coverage by New MRR value. This metric provides further insights on supporting sales revenue targets.

E.g.:

Your business goals include increasing your market share in the SMB niche. When you dive into the pipeline coverage ratio which is on target for 5x sales pipeline coverage, you discover that a few potential mid-market opportunities have skewed your number and there aren’t many SMB accounts to close and meet sales quotas.

This could be dangerous since your sales team may take longer to close the bigger deals at a lower closing ratio than what your sales pipeline coverage was accounting for.

At this point, the marketing team needs to work on better coverage of the sales pipeline commit.

TIP: When budgeting for this KPI, take into account historical sales trends of closing ratios by deal size cohorts

Pros of this KPI:

- Aligned with business objectives: This KPI provides a practical foundation for the previous KPI. By factoring in New MRR cohorts by deal size the KPI mitigates some of the risks of an inflated sales pipeline coverage ratio.

- Sales relevant marketing efforts: By digging into the cohorts the marketing team gains information to ensure that content creation to drive lead generation across paid, organic, and other channels are optimized towards the ideal customer profile and buyer personas. If the sales New MRR targets are dependent on a specific cohort the marketing content mix should be optimized for that specific cohort.

Challenges:

- The product-market fit needs to be well established: This metric may be less relevant for a SaaS product that is still trying to establish a product-market fit. Without a product-market fit, it will be a guessing game to figure out where your growth should be coming from.

On the other hand, this KPI may well provide you with a leading indicator on your ICP. There’s more than one way to a product-market fit. - Some channels may not respond in a timely or efficient manner to tweaks based on this KPI: The MRR sales pipeline by deal size cohort is often used as an optimization metric to guide the sales pipeline coverage ratio. However, some marketing channels may not respond to tactical marketing changes.

For example, your SEO strategy may be leveraging blog content that is bringing more SMBs than the ideal Enterprise prospects into the pipeline. A change in content strategy may take some time to execute and it may be a couple of quarters or more before the results of the changes show up in your pipeline.

Or your costs per lead may trend higher as you attend more events to acquire more Enterprise leads.

Which brings us to the next KPI.

3. Target Cost Per Lead

I don’t think marketing heads need an in-depth explanation of this metric.

Cost per lead= cost of marketing to acquire leads/number of leads acquired

In combination with the previous two KPIs, this metric can prevent runaway costs, help ROI, and assist with adequate budget allocation.

If all three KPIs are on target and your Net MRR is also on target, your marketing is probably well optimized and bringing in the best-fit customers your B2B SaaS requires

Net MRR = New MRR + Expansion MRR – Churn

If you are performing better than targets on all these KPIs as well as your Net MRR for more than two quarters, it may be an indicator that you should be aiming for higher KPI targets. Or that you’ve arrived and you should be scaling up faster to T2D3 growth.

Is branding dead? Is design dead? Is story telling dead?

See? I’m not immune to overused tropes. Perhaps the click-bait factor on ‘X is dead’ titles would positively drive those KPIs I mentioned. I digress.

Critics of the above KPI based approach may point out that the approach comes at the expense of branding. However, I strongly believe that it makes a strong case for result-oriented brand storytelling. After all, it is very difficult to sustainably build on the 3 KPIs without brand credibility to support it.

The KPI approach brings together 3 overarching success factors for modern marketing:

- People

Be it sales and marketing alignment, creating an environment for individual and business growth, or driving the customer experience, the common element revolves around human relationships.

One of my biggest challenges has been to find enough people with a good grasp of revenue-focused marketing. It’s difficult to find those who can unlearn the vanity-metric-centered behavior coming from the ‘low barriers to entry on social media’ approach to marketing.

One way to fix this is to coach and build a team that can connect the dots between marketing tasks and revenue numbers.

This is easier said than done. Habits are difficult to unlearn. There is always a temptation to fall back on old ways.

Incentivizing teams to focus on these KPI targets then becomes another tool in the arsenal. As someone mentioned, and I paraphrase, “Show me what I’m measured by and I’ll show you what I devote my time on”. - Technology

In my experience, technology and automation on the marketing and sales sides have only increased the need for collaboration across the teams.

The era of the citizen developer is here. Marketing and sales teams are increasingly empowered to drive superlative customer experiences with low code/no-code.

Due to the growth of marketing technology, the measurement of marketing efforts towards revenue is in many ways easier to track than it has ever been Although, in many ways, it is still a work in progress. - Processes

All the technology we have begins to waver without processes that sustain scalability.

This leads back to coaching, discipline, and relationships to guide the digital transformation of marketing as a revenue center.

Which brings us full circle to the fact that these B2B SaaS marketing KPIs are about focussing the SaaS marketing org to play an effective role in sustainable and predictable recurring revenue. At its core, it’s about effectively measuring the return on storytelling and brand-building.

p.s.: Here’s a one-page digital marketing plan template to bring it all together.